Washington Landlords and Tenants: Remaining COVID-19 Eviction Protections Lifted

The National Response to COVID-19: A Brief Overview

In early 2020, the nation was in a state of emergency due to the COVID-19 pandemic. Recognizing the risk of mass evictions as a result of the pandemic, many state and local governments enacted a moratorium on residential evictions. These moratoria effectively denied landlords the right to pursue an unlawful detainer (eviction) action – the only legal means of removing tenants for failure to pay rent.

Washington State’s Eviction Moratorium and the ERPP Initiative

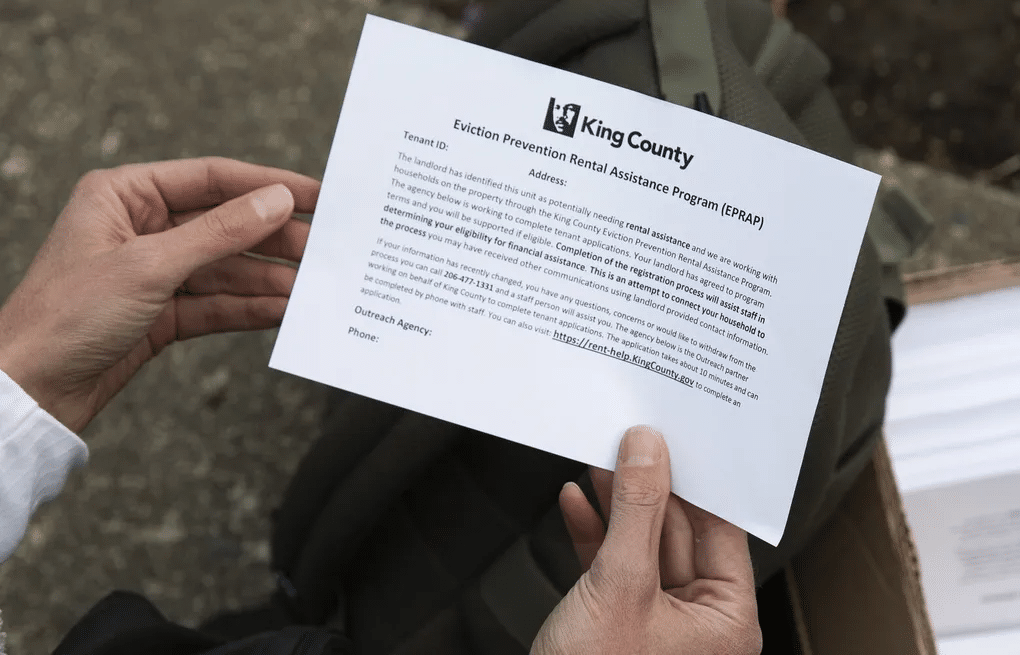

In Washington state, an eviction moratorium was in effect from March 18, 2020, through October 31, 2021. Following the end of the moratorium, the Washington state legislature passed E2SSB 5160 authorizing the establishment of an Eviction Resolution Pilot Program (ERPP) in any county in Washington state. The ERPP was designed to facilitate dispute resolution between landlords and tenants, by connecting them with a dispute resolution specialist and resources such as rental repayment assistance. Once the eviction moratorium ended on November 1, 2022, six counties in Washington state elected to participate in the ERPP: King, Pierce, Snohomish, Clark, Spokane, and Thurston. Each program established a local Dispute Resolution Center (DRC) and operated pursuant to a standing order issued by the local superior court.

Pursuant to the ERPP, landlords in participating counties were required to provide tenants with an ERPP Notice, advising tenants of their rights under the ERPP, and a proposed repayment plan for outstanding rent amounts owed. Upon receiving an ERPP Notice and proposed repayment plan, tenants had 14 days to negotiate a proposed settlement with their landlord via the local DRC. In circumstances where the landlord and tenant failed to come to an agreement during the 14-day period, or the tenant breached the agreement, the landlord was then authorized to send the tenant a 14-day notice to pay or vacate.

The End of ERPP and Its Impact

The ERPP ended by statute on July 1, 2023. Dispute Resolution Centers statewide reported that over 78,000 cases were closed and completed during the life of the program, and 73% of these cases closed because the landlord and tenant reached an agreement. Now that the program has ended, landlords are no longer required to provide tenants with an ERPP Notice or a proposed repayment plan before proceeding with an unlawful detainer for unpaid rent.

The end of the ERPP marks the end of all remaining COVID-19 eviction protections for tenants. However, some counties in Washington state still maintain permanent eviction moratoriums during parts of the year. In Seattle, City Council Ordinance 126041 creates a defense to eviction for tenants who would have to vacate their housing between December 1 through February 28 each year. Additionally, Seattle City Council Ordinance 126369 creates a defense to evictions for anyone in school, with children in school, or working at a school during the City of Seattle Public school year, which is generally the beginning of September through mid-June.

Need Legal Assistance? Contact Lether Law Group

Lether Law Group has attorneys licensed and actively participating in eviction proceedings in Washington state. To the extent that you have any questions about Washington landlord-tenant law or eviction moratoria, please feel free to contact us by phone at (206) 467-5444 or via email at info@letherlaw.com.